Here’s the truth: equalizing different types of retirement plans leads to unfairness, complexity, and, ironically, higher costs.

A Common Scenario

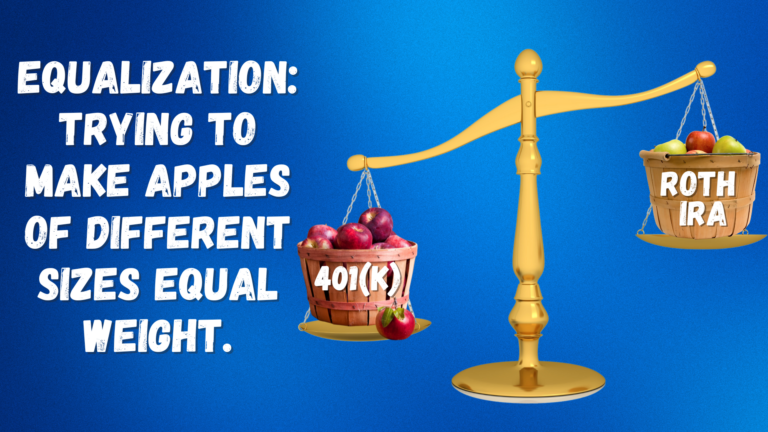

Let’s stop pretending that a 401(k) and a Roth IRA are interchangeable. Spoiler: they aren’t. One party keeps $100,000 in a 401(k), while the other gets $80,000 in a Roth IRA and $20,000 from the 401(k).

Fair? Not at all. One is taxed upfront, the other later. You’re comparing apples to oranges.

And when you try to equalize a 401(k) with a Cash Balance Plan (a type of pension), it’s even worse.

A Cash Balance Plan is designed for limited growth—employers set conservative targets to ensure they can keep their promises, unlike the flexibility and growth potential you get with a 401(k).

You’re mixing apples, oranges, and bananas. It’s not a fair trade, no matter how you slice it. Yet, many practitioners still push this “solution” to reduce transfers.

Does Equalization Really Simplify?

No. It leaves you with unequal assets, differing growth rates, and varying tax treatments. One side walks away with more questions than answers. All in the name of convenience? That’s not equity. It’s a problem.

A Proven Pattern

I’ve been sounding the alarm on this for years. The pattern is always the same:

Equalization creates more issues than it solves. What looks like cost-saving often results in:

- More consulting fees

- More complexity

- Clients frustrated with the outcome

What’s the Alternative?

Simple. Split each account correctly. Give each party their fair share of every plan.

If you have to equalize, do it within the same type of account—stick to apples with apples—Roth to Roth, but never 401(k) to 401(k).

Why? Because equalization forces clients to pay for a manual post-date of cutoff analysis—something the plan would do for free automatically if you didn’t equalize.

Be upfront about the growth differences and added costs. No surprises.

Make sure everyone, including you, fully understands the deal. Right now, clients are only getting half the truth. It’s not about doing what’s easy; it’s about doing what’s right.

The Bottom Line

It’s time to stop treating retirement plans as one-size-fits-all. Equalization isn’t equity—it’s a mistake.

Let’s get it right.